Online Account with No Fees and card for €0

Spend and earn: €150 for your things

For your savings, for that unexpected expense... Use them for whatever you need!

- Become a BBVA customer with the Fee-Free Online Account.

- We will refund you up to €150 of the purchases you make with your Aqua Debit Card during the 30 days after you sign up.

Enter this code when you open your account before 04/07/2026. Limited to the first 10,000 sign-ups:

There's not long left, so hurry!

Or with up to €760 over one year for using your account

What do you need?

BBVA makes it easy for you

Open a Fee-Free Online Account with €760 the first year

For your new plans

-

For every change

We'll be by your side whenever you need us: if you retire, have children, change homes, if you're looking for a car, and much more.

-

Only worry about your luggage

We'll help you to organize the funds for your trip, so your only concern is enjoying your destination. -

Or start a business without fear

We help you with the paperwork at every stage, to make starting your business easier.

What if we get to know each other a little better?

Sustainability information

Do you want to win a check for €100?

Take part in this draw for 300 Amazon checks of €100 while you enjoy the summer. Just for using the app!

If you're thinking about transferring your fund to BBVA, go all in

Because when you transfer a fund from another bank, you will get 2% of the amount as a bonus.

Sustainability at BBVA

Solutions for your commitment to the environment and social development.

See what BBVA can do for you

Download the BBVA app and start enjoying all its benefits.

-

BBVA Collectives

Depending on your profession, we offer services and products with conditions designed just for you.

At BBVA, we know that each profession has specific needs. Learn about the services and offers we have designed for you. -

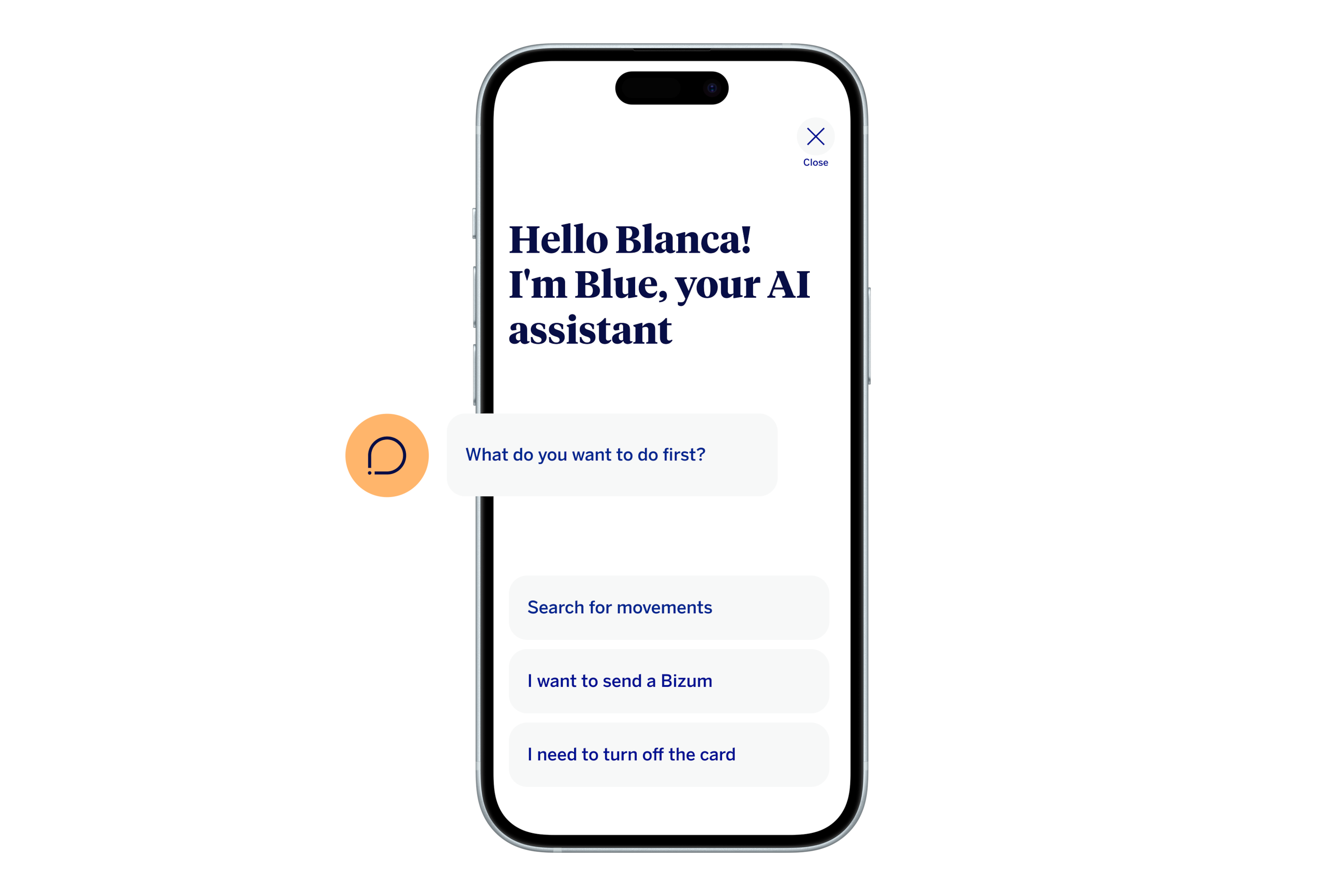

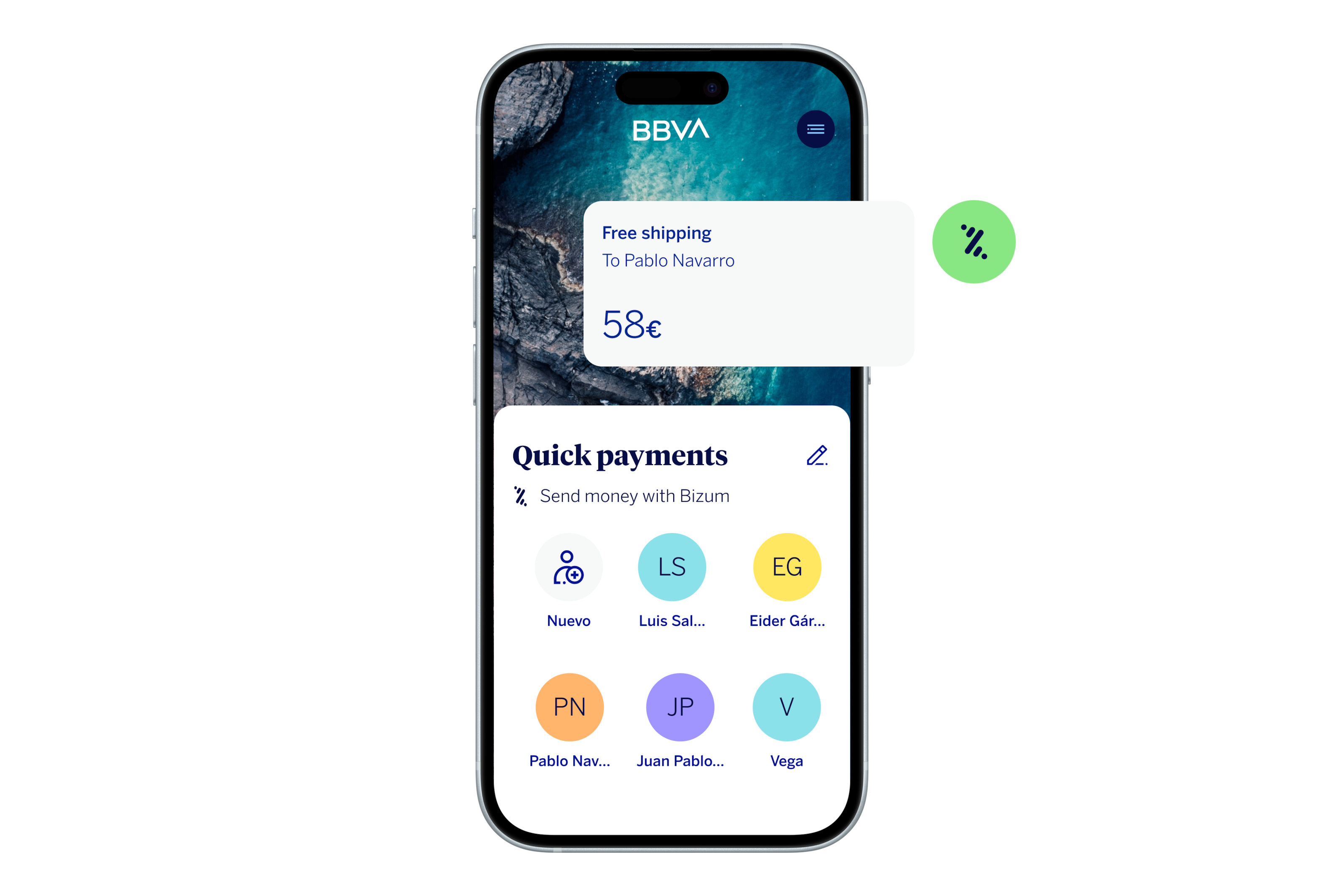

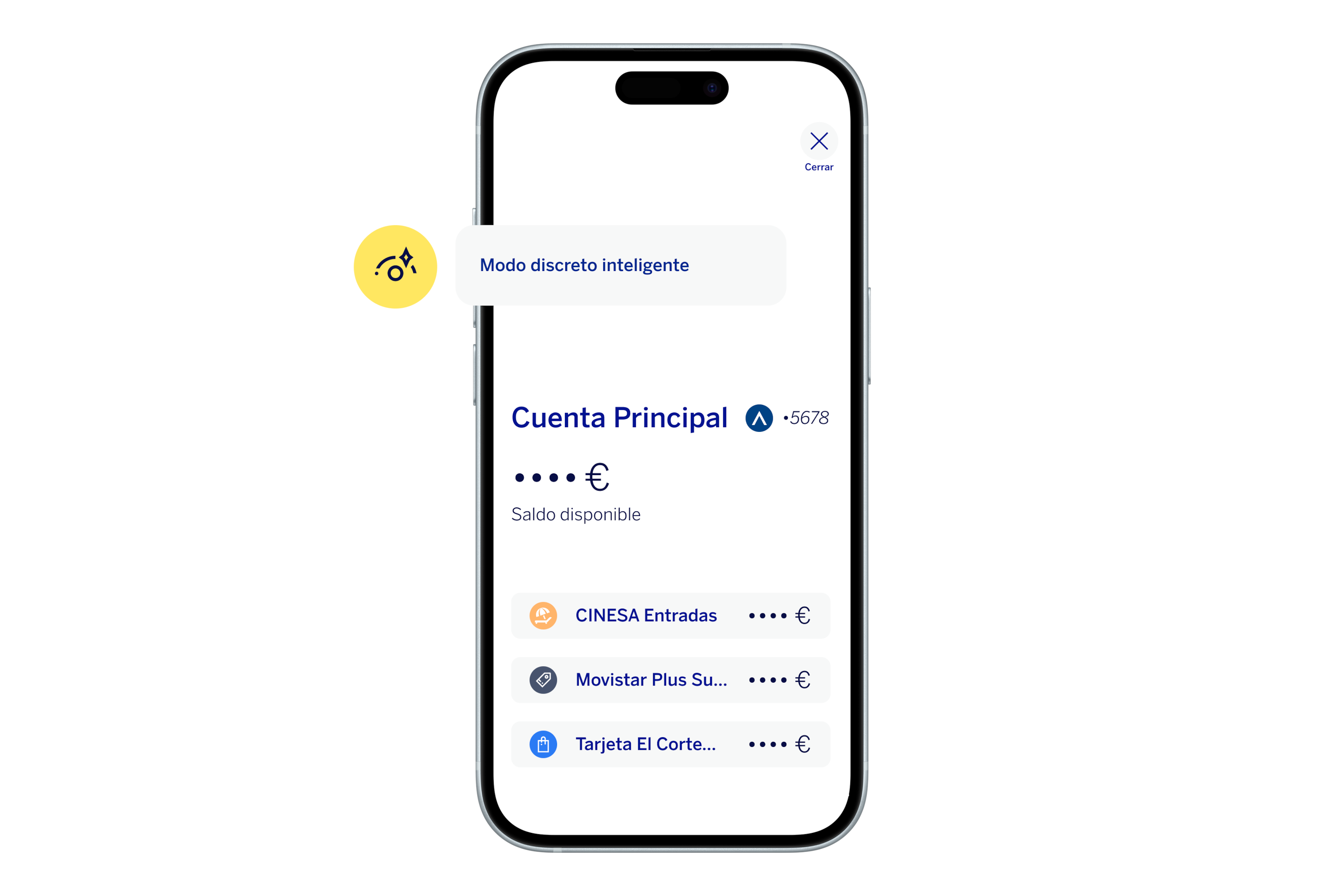

Everything from your cell phone

Discover everything you can do from the BBVA app.

- Turn your cards on and off.

- Pay non-automatic bills with just a photo.

- Withdraw cash without a card.

- Pay with your cell phone.

-

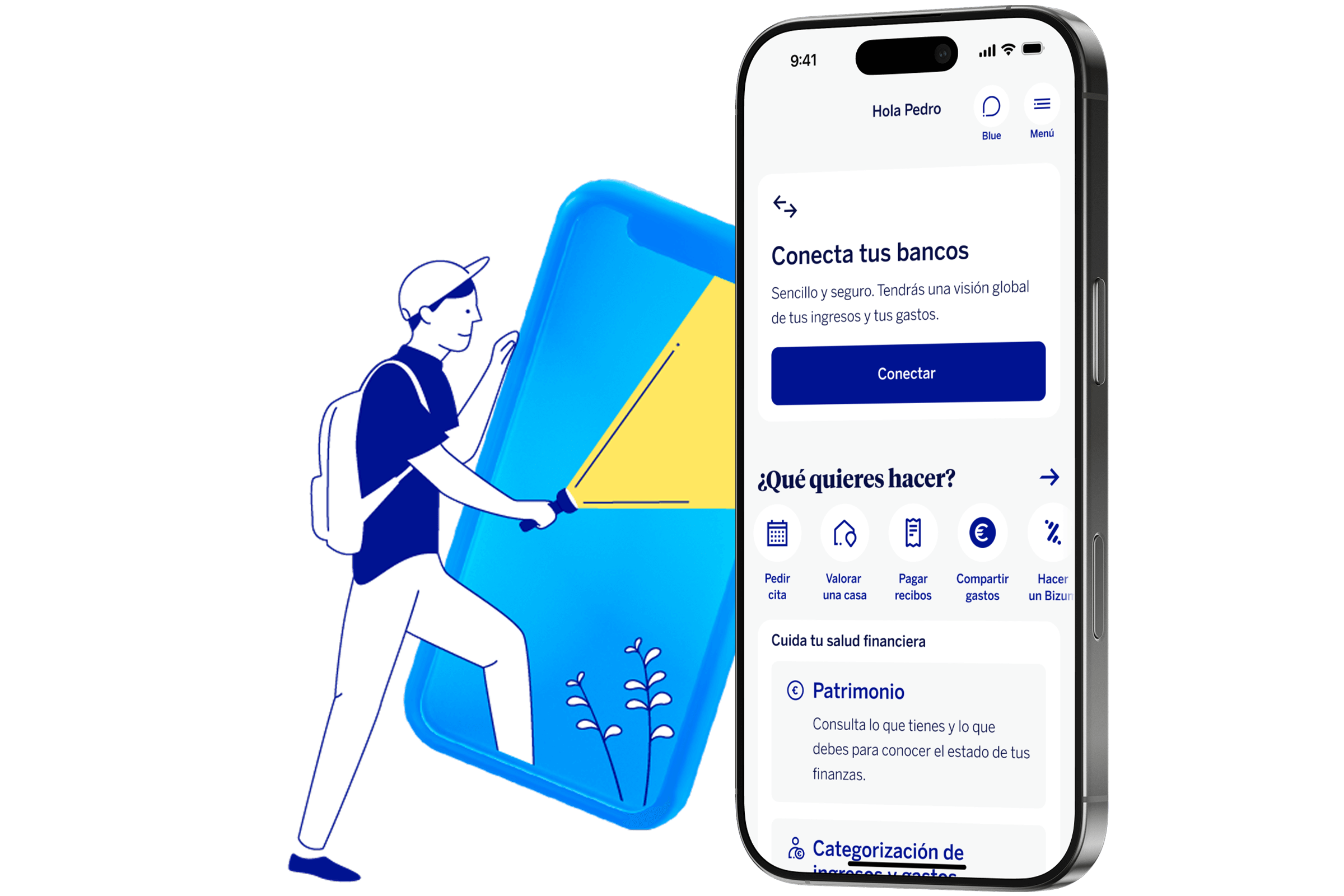

Aggregation service

View the accounts in your other banks from the BBVA app.

- Check the status of your accounts, cards, recent activity, etc.

- BBVA will never ask you for your passwords. Your payments and transfers will be made from your other banks.

-

BBVA Valora

BBVA Valora helps you evaluate the price of a used car, a home and much more.

With BBVA Valora, you'll know the estimated value of a home so you can decide whether to rent or buy. If you already have a home, BBVA Valora can help you combine all your home expenses and get related information. You can also analyze the price of a car, whether you wish to sell it or buy one.