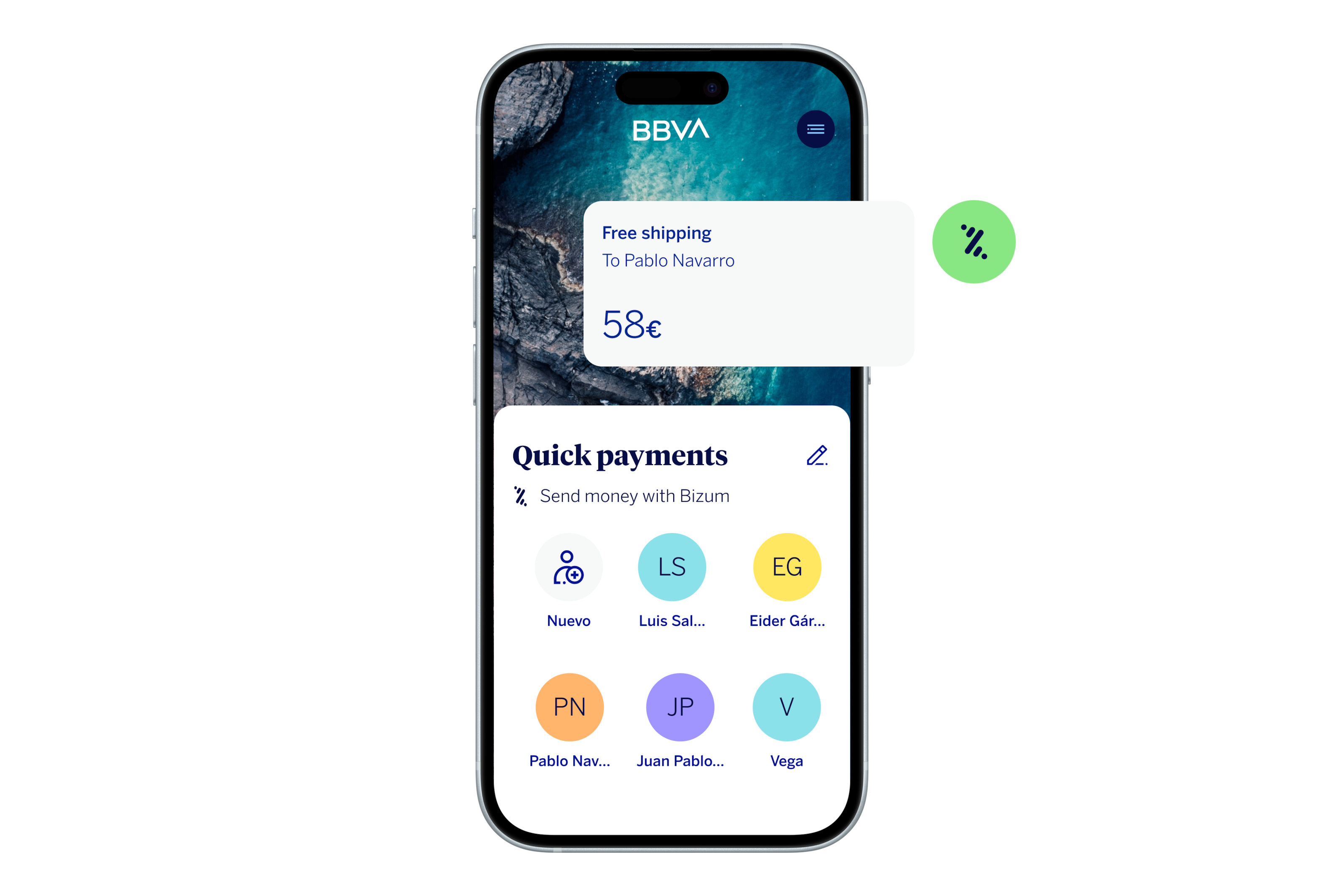

Do you want to win a check for €100?

Take part in this draw for 300 Amazon checks of €100 while you enjoy the summer. Just for using the app!

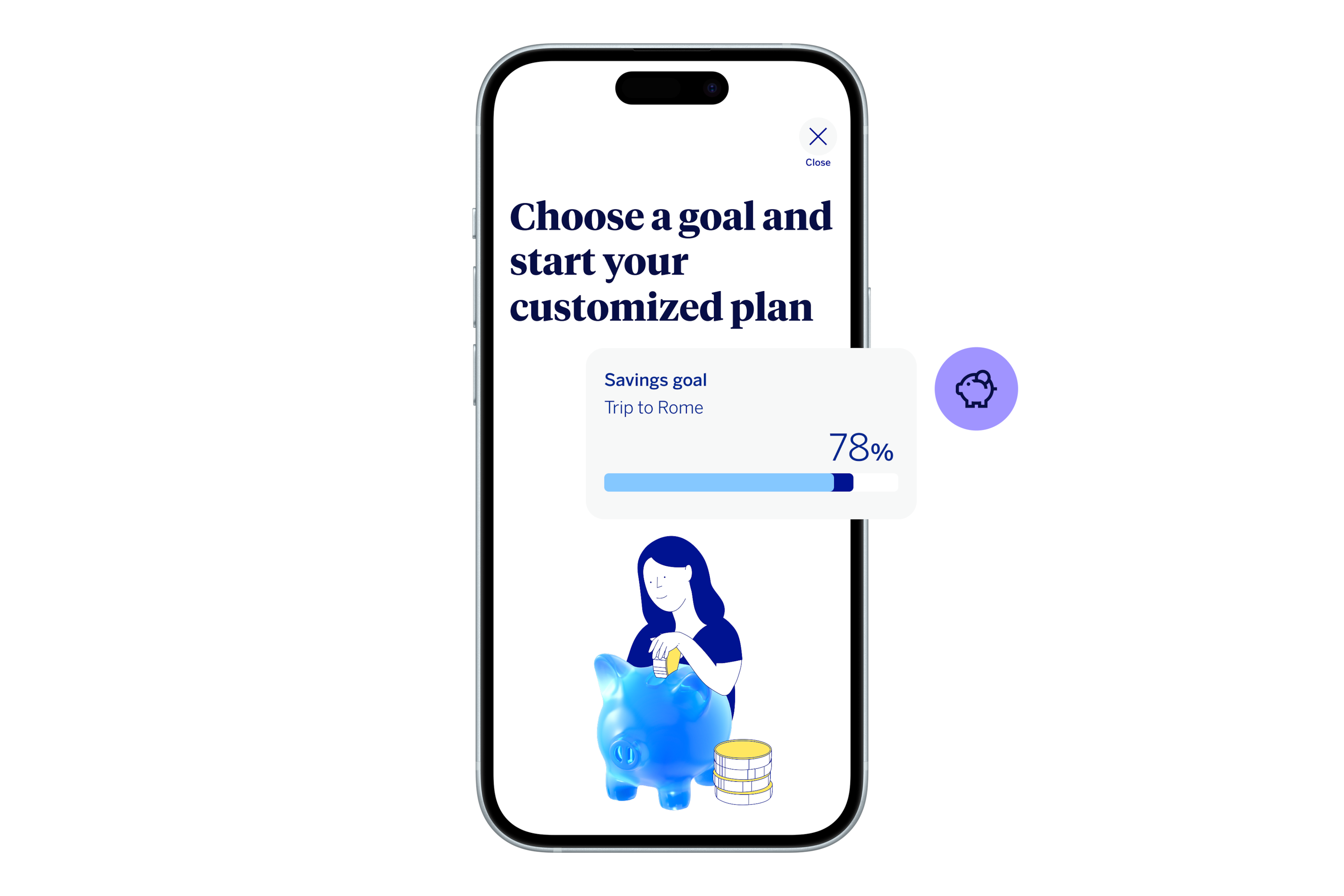

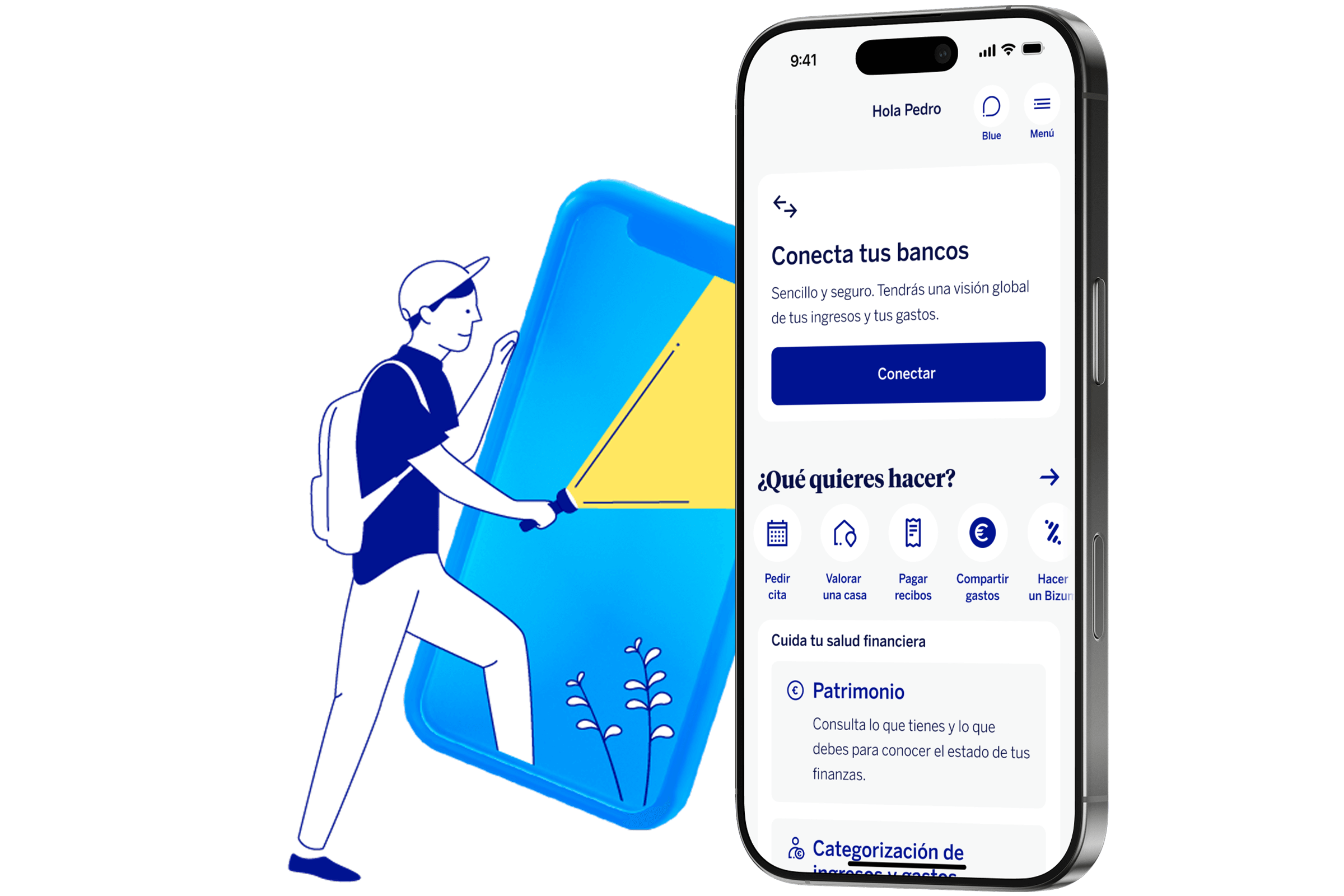

If you're thinking about transferring your fund to BBVA, go all in

Because when you transfer a fund from another bank, you will get 2% of the amount as a bonus.

Sustainability at BBVA

Solutions for your commitment to the environment and social development.