BBVA Energy Efficiency Loan

Financing with special conditions

- From $${tinBon}% NIR/$${taeBon}% APR with your paycheck at BBVA.

- To $${tinNoBon}% NIR/$${taeNoBon}% APR with your paycheck not direct deposited at BBVA.

With NO commitment fee! Calculate your example and get the financing you need.

We can help you save on routine energy costs

From $${tinBon}% NIR/$${taeBon}% APR with paycheck or pension direct deposited at BBVA.

To $${tinNoBon}% NIR/$${taeNoBon}% APR without a paycheck or pension direct deposited at BBVA

-

No commitment fee.

-

Up to €75,000 and a term of 2 to 8 years.

Do you want to know how much you could save on your bill with solar panels?

This example will make it clearer

-

EXAMPLE OF A LOAN WITH PAYCHECK OR PENSION DIRECT DEPOSITED

- Loan amount: €10,000.

- Commitment fee: $${openingFeeAmount} €.

- Repayment period: 8 years (96 months).

- Constant monthly payment: $${monthValueBon} €.

- Interest rate: $${tinBon}% NIR/$${taeBon}% APR.

- Total to repay: $${totalValueBon} €.

EXAMPLE OF A LOAN WITH NO PAYCHECK OR PENSION DIRECT DEPOSITED- Loan amount: €10,000.

- Commitment fee: $${openingFeeAmount} €.

- Repayment period: 8 years (96 months).

- Constant monthly payment: $${monthValueNoBon} €.

- Interest rate: $${tinNoBon}% NIR/$${taeNoBon}% APR.

- Total to repay: $${totalValueNoBon} €.

You can improve the interest rate

-

To be eligible for a discount in the interest rate of the Energy Efficiency Loan, you only need to meet one of these conditions:

- Direct deposit a paycheck of at least €600.

- Direct deposit a pension of at least €300.

What projects can you finance?

-

With this loan, you can make home renovations and purchase devices designed to save energy, helping you consume responsibly and reduce your carbon footprint:

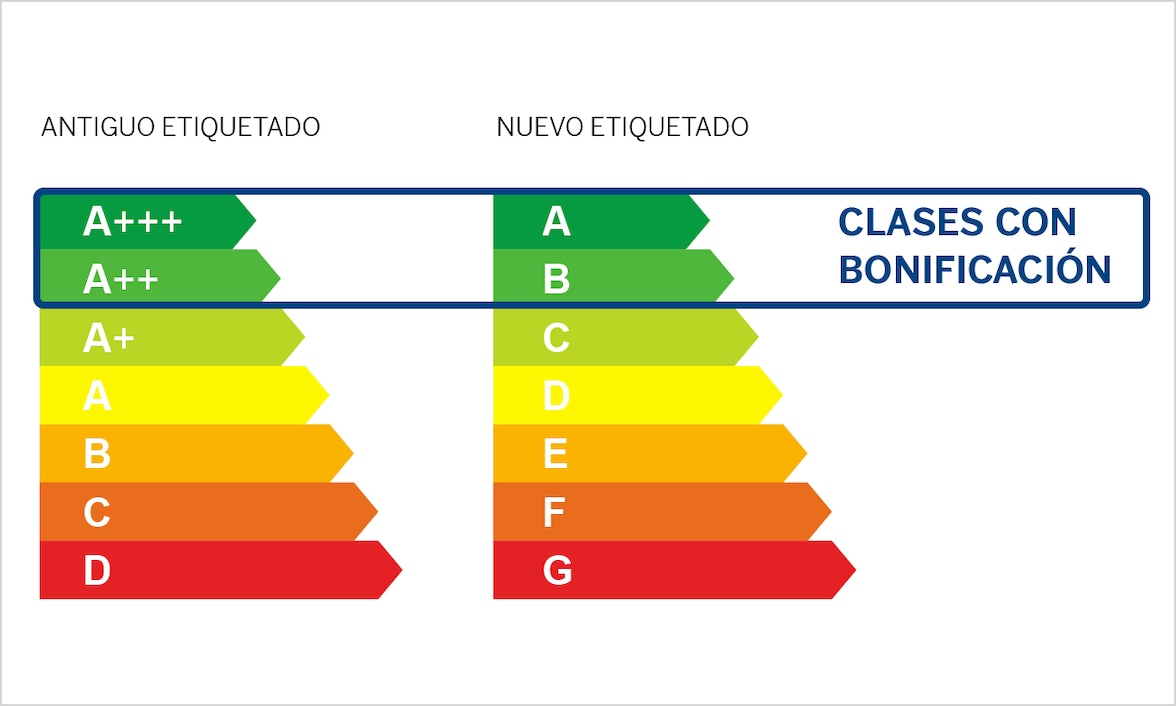

- Lighting: The lighting system must be in one of the two highest energy efficiency categories.

Check the energy label ratings eligible for a discount at the bottom of this page.

- Heating/air-conditioning/ventilation/hot water: All condensation boilers are included, as are HVAC systems, provided that the latter are in one of the two highest energy efficiency categories.

- Control and automation: Lighting, HVAC, installation of motion detectors for lighting, and automatically turning installations on and off.

- Insulation: Improvements to the thermal insulation of the building envelope (façades, roofs, etc.), adding thermal insulation to the existing insulation, or installing windows with two or three panes.

- Household appliances: Purchase of large volume appliances (excluding microwave and small appliances); must be in one of the two highest energy efficiency categories.

- Mobility: Purchase of electric vehicles, plug-in hybrids, installation of charging points for electric vehicles, bicycles (with and without motors) and electric scooters.

- Solar panels: Installation of solar panels for self-supply.

Are you planning to buy or replace an electric or plug-in hybrid vehicle?

How much money can I request?

-

From a minimum of €3,000 up to a maximum of €75,000. If you need a smaller amount, you can apply for one of our credit cards.

How long do I have to pay it off?

-

You can choose from a minimum period of 2 years up to a maximum period of 8 years, depending on the amount requested.

Find out about energy labeling

Would you like more information?

You might also be interested in

Be a BBVA customer.

- At BBVA we want to help you with your day-to-day errands.

- We are working to make your life a little easier with our digital solutions.

- Our approach is based on transparency, clarity and responsibility.