¿Qué es el euríbor?

¿Cuál es el valor del euríbor?

Ahora que ya conoces lo qué es el euríbor, el siguiente paso es saber calcularlo. El euríbor se obtiene tras hacer la media de los “precios de los préstamos” concedidos por los grandes bancos europeos entre sí.

Así, y a diario, cada entidad debe comunicar su tipo de interés. Tras ello, se eliminan el 15% de las operaciones que tengan el tipo de interés más alto y el 15% de operaciones que lo tengan más bajo. Del 70% restante se hace la media, la cual se redondea hasta los 3 decimales.

¿Cuando se publica el valor del euríbor?

El valor del euríbor se conoce cada día a las 11 de la mañana. Sin embargo, ni esta cifra que se da a diario, ni su evolución semanal y/o quincenal del euribor, es el que impacta en el valor de la cuota de tu hipoteca. El porcentaje que suelen usar las entidades bancarias en los préstamos hipotecarios de tipo variable es la media mensual del euríbor (a plazo de 12 meses).

¿Qué tipos de euríbor existen?

Son 9 los tipos de euribor, en base al plazo para el cual se calcula. Son:

- Euríbor diario.

- Euríbor a 1 y 2 semanas.

- Euríbor a 1, 2, 3 y 6 meses.

- Euríbor 1 año.

¿Qué relación tienen el euríbor y las hipotecas?

La relación entre una hipoteca con el euríbor es muy estrecha, aplicándose a 2 de sus tipos: la hipoteca variable y la mixta.

Esta se caracteriza, principalmente, por tener un tipo de interés compuesto. Se denomina así porque no es valor fijo, sino que se obtiene de la suma de un diferencial, que es siempre el mismo, y un índice de referencia (habitualmente, el euríbor) que puede evolucionar (en positivo o negativo) durante el periodo de amortización de la hipoteca.

El contar con un tipo de interés compuesto, y de un euríbor que evoluciona constantemente, hace que la cuota mensual de la hipoteca variable pueda subir o bajar cada cierto tiempo. Se produce una revisión periódica (la más habitual es cada seis o doce meses, haciéndose en BBVA cada 12 meses) para actualizarlo en función del valor del euríbor (lo que cambiará la cuota al alza o a la baja).

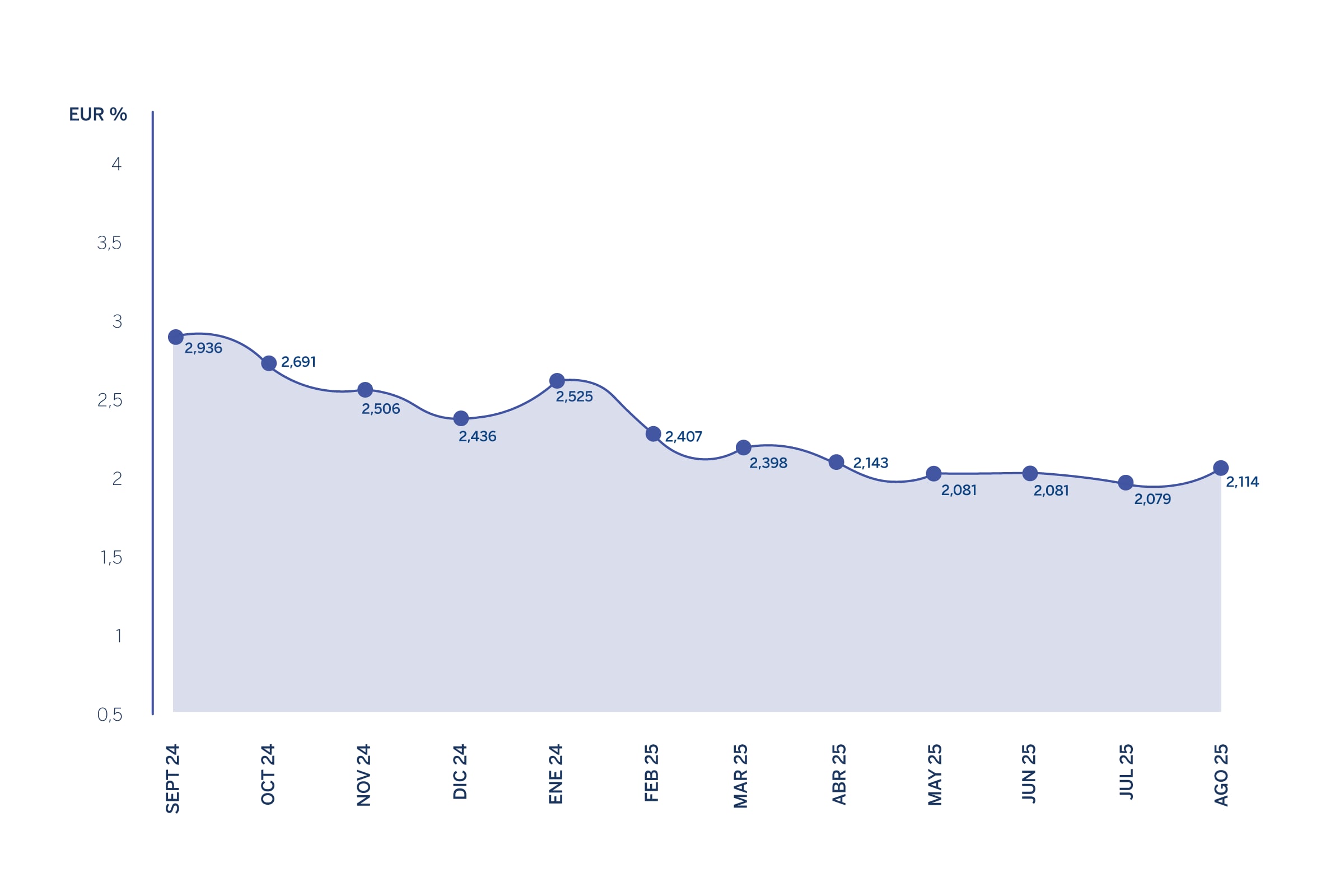

Evolución del euríbor en el último año

El euríbor, como hemos indicado previamente, se obtiene a diario de la media de los tipos de interés con los que operan las principales entidades bancarias en la concesión de préstamos entre sí.

La evolución del euríbor, si tenemos esto en cuenta, debe verse como algo natural y que, a la hora de pensar en la solicitud de un préstamo, hay que tener siempre en cuenta. Atento a esta tabla que recoge la evolución mensual del euríbor (BOE, a plazo de 12 meses) en el último año:

Así ha evolucionado el euríbor (BOE, a plazo de 12 meses) en el último año

| Histórico de la evolución del euríbor en el último año | |

|---|---|

| Histórico de la evolución del euríbor en el último año

Septiembre 2025

|

2,172

|

| Histórico de la evolución del euríbor en el último año

Agosto 2025

|

2,114

|

| Histórico de la evolución del euríbor en el último año

Julio 2025

|

2,079

|

| Histórico de la evolución del euríbor en el último año

Junio 2025

|

2,081

|

| Histórico de la evolución del euríbor en el último año

Mayo 2025

|

2,081

|

| Histórico de la evolución del euríbor en el último año

Abril 2025

|

2,143

|

| Histórico de la evolución del euríbor en el último año

Marzo 2025

|

2,398

|

| Histórico de la evolución del euríbor en el último año

Febrero 2025

|

2,407

|

| Histórico de la evolución del euríbor en el último año

Enero 2025

|

2,525

|

| Histórico de la evolución del euríbor en el último año

Diciembre 2024

|

2,436

|

| Histórico de la evolución del euríbor en el último año

Noviembre 2024

|

2,506

|

| Histórico de la evolución del euríbor en el último año

Octubre 2024

|

2,691

|

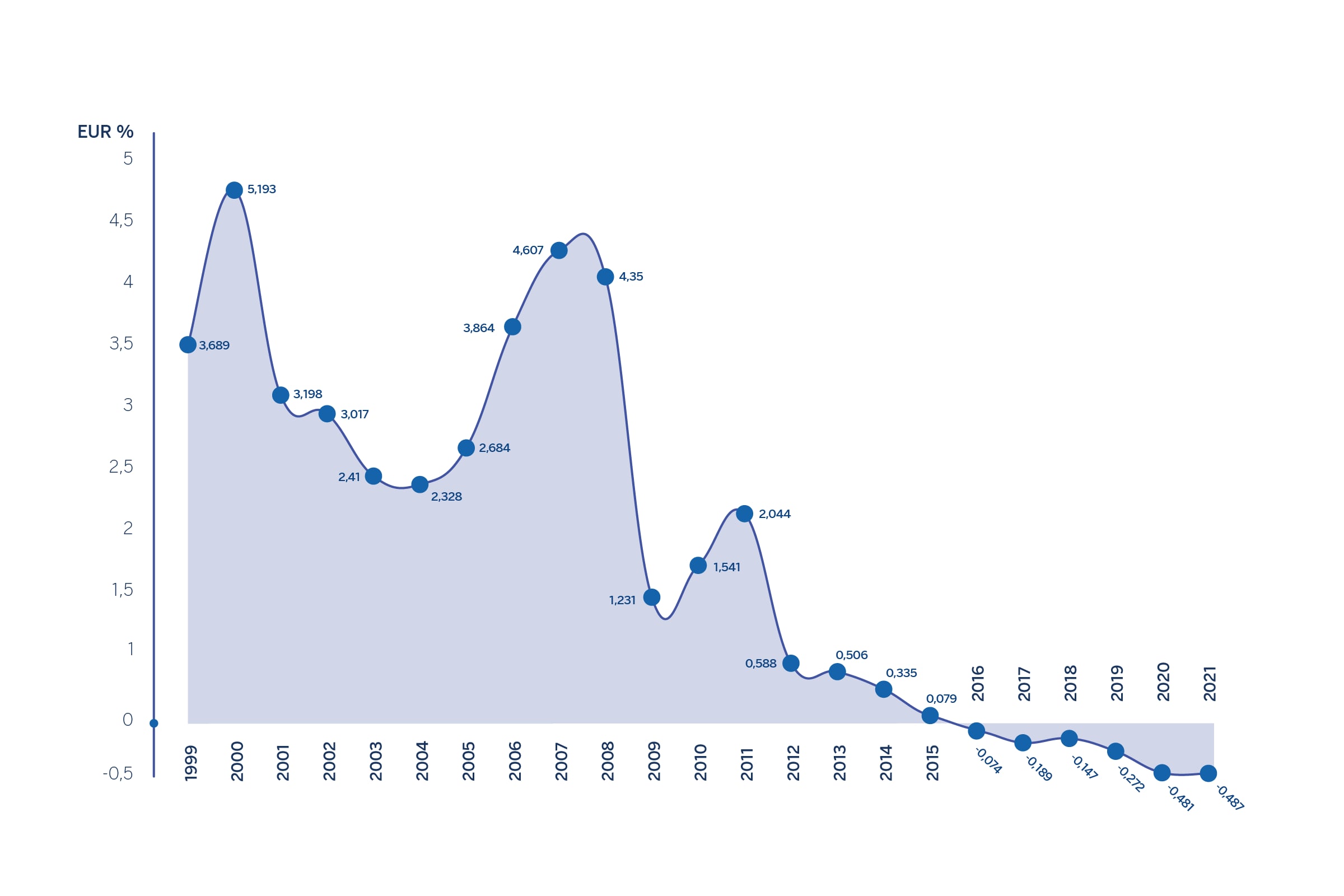

| Histórico de la evolución del euríbor desde su implantación en 1999 | |

|---|---|

| Histórico de la evolución del euríbor desde su implantación en 1999

1999

|

3,689

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2000

|

5,193

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2001

|

3,198

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2002

|

3,017

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2003

|

2,41

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2004

|

2,328

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2005

|

2,684

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2006

|

3,864

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2007

|

4,607

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2008

|

4,35

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2009

|

1,231

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2010

|

1,541

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2011

|

2,044

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2012

|

0,588

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2013

|

0,506

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2014

|

0,335

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2015

|

0,079

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2016

|

-0,074

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2017

|

-0,189

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2018

|

-0,147

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2019

|

-0,272

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2020

|

-0,481

|

| Histórico de la evolución del euríbor desde su implantación en 1999

2021

|

-0,487

|