Los estudiantes universitarios son un grupo de población con unas particularidades concretas. Son mayores de edad, pero suelen vivir en casa de sus padres, y los que se han mudado para estudiar en otra ciudad suelen estar sustentados por sus progenitores, que son los que pagan los gastos mensuales que tienen sus hijos/as (ya que estos no tienen un trabajo estable que les permita afrontarlos).

Para ello, los bancos ponen a su disposición un tipo de tarjeta bancaria especial para estudiantes universitarios, con una serie de condiciones especiales, las cuales os vamos a explicar con todo detalle en este artículo.

¿Qué es una tarjeta de crédito para estudiantes?

¿Cuáles son los requisitos para obtener una tarjeta de crédito para estudiantes?

Existen una serie de condiciones a cumplir, por lo normal, si se quiere obtener una tarjeta de crédito para estudiantes:

- Ser mayor de edad (superar, por tanto, los 18 años).

- Contar con DNI (u otro documento identificado, por ejemplo, el pasaporte).

- Disponer de una cuenta bancaria (como, por ejemplo, la Cuenta Joven Sin Comisiones de BBVA).

- Estar matriculado en un centro universitario o de estudios.

- Facilitar un justificante de ingresos (normalmente, en este caso, suelen hacerlo los padres).

- Entregar un comprobante de que se habita en un domicilio (recibo de la luz, el agua o el gas, por ejemplo).

Además, sin ser obligatorio, se valora el tener un buen historial crediticio.

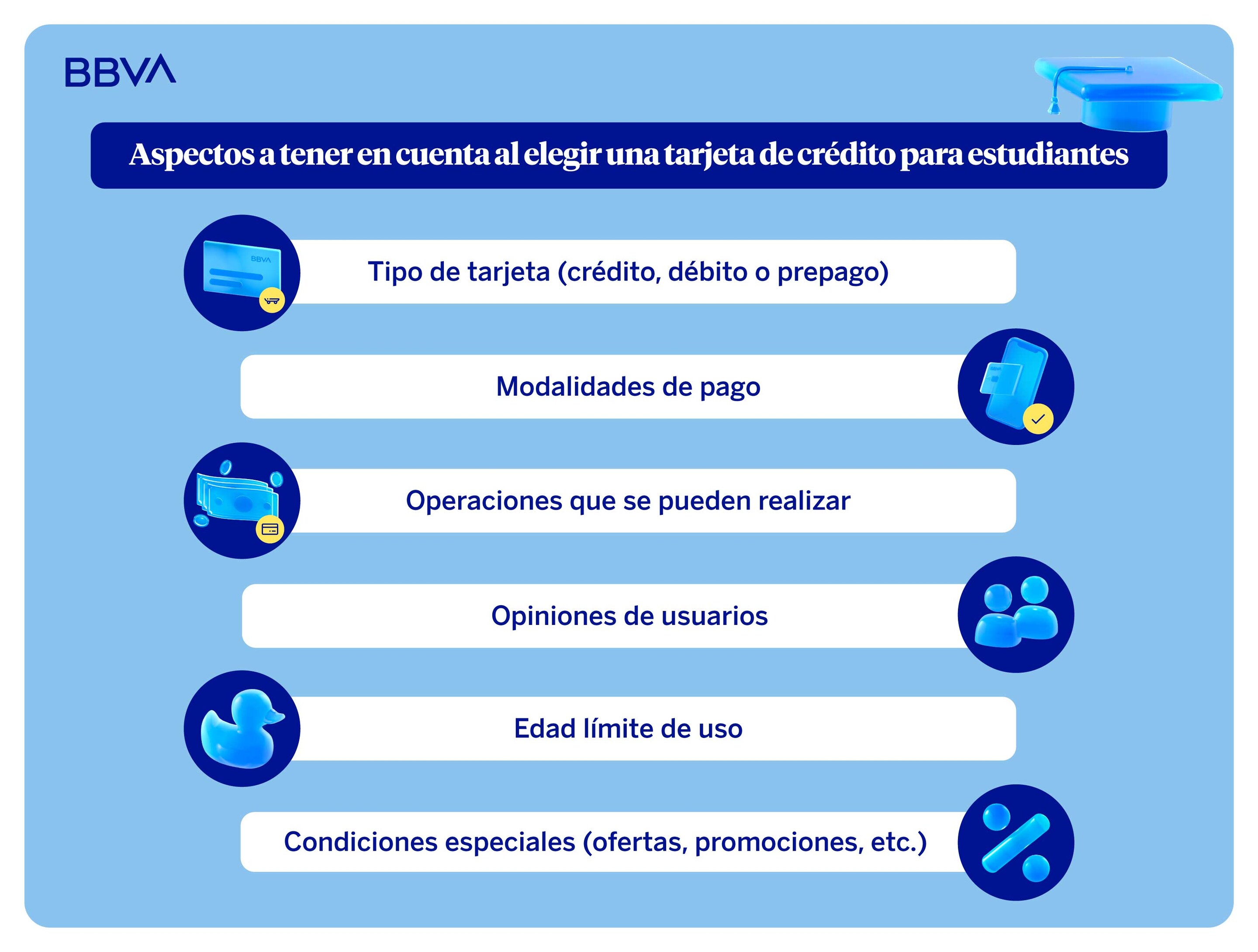

¿En qué aspectos hay que fijarse al escoger una tarjeta de crédito para estudiantes?

En primer lugar, en el tipo de tarjeta que se quiere contratar, que puede ser de crédito, las más común, o también de débito o prepago. En segundo lugar, las modalidades de pago que ofrece, solo en el caso de que se opte por una de crédito (si es de débito, lo gastado se carga en la cuenta en el momento del pago), y las comisiones a pagar (aunque hay tarjeta de crédito para estudiantes que no las tienen).

En tercer lugar, hay que ver la operativa que se permite, es decir, las operaciones que se pueden realizar con la tarjeta de crédito (sacar dinero, pagar compras, etc.). En cuarto lugar, no hay que olvidarse de revisar, más ahora que vivimos en la era digital, las opiniones de otros usuarios. Por último, hay que comprobar la edad límite de la tarjeta (ya que esta es la que marca la aplicación de sus ventajas) y, sobre todo, cuáles son esas condiciones especiales que se incluyen en la tarjeta de crédito para estudiantes.

¿Cuáles son las ventajas más habituales de la tarjeta de crédito para estudiantes?

Estos son los beneficios que suelen ofrecer las tarjetas de crédito para estudiantes:

- Promociones a nivel educativo (sobre todo en lo referente a libros, material para las clases, etc.).

- Promociones y descuentos en establecimientos (hoteles, tiendas, etc.) siempre que se pague en ellos con la tarjeta de crédito para estudiantes.

- Descuentos en transporte.

- Descuentos en viajes al extranjero.

- Seguro de viaje o accidentes sin coste.